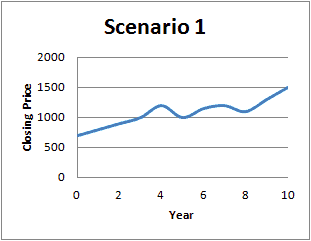

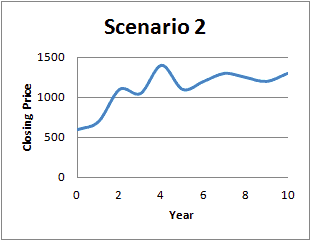

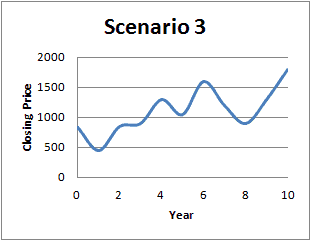

Pop quiz: Pretend your investment portfolio looked like one of these three graphs. Which of these represents an 8% average annualized return each year?

Image may be NSFW.

Clik here to view. Image may be NSFW.

Image may be NSFW.

Clik here to view. Image may be NSFW.

Image may be NSFW.

Clik here to view.

The answer:

All of them!

An Introduction to the 8% Return:

One of the most widely quoted and useful statistic in personal finance is the concept that stocks will return an average return of 8% year after year. This value is based upon a trend of stock market returns from over almost a whole century.

Although historical returns never guarantee future returns, many investors believe that if they put their money into a stock index fund that they will be able to achieve this 8% return over the long haul.

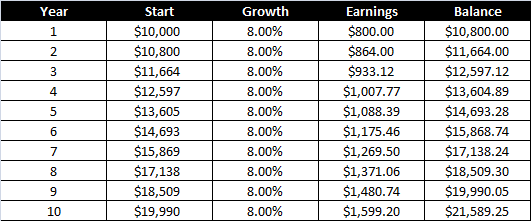

To you and me, that means that an investment of $10,000 would hypothetically look like this:

Image may be NSFW.

Clik here to view.

What Does This Mean for My Money?

Unfortunately, as real life goes, your money hardly ever actually looks like this chart. Wouldn’t it be nice if your money just always went up and up?

The true benefit of this statistic is this:

- It helps you plan your finances for the long-term.

For example, if you have 30 years until retirement, how can you estimate how much you should be saving each month to hit your goals? Knowing that an index fund may return you 8% helps to provide some basis for your planning.

Arithmetic vs. Geometric Average Return – Don’t Use the Wrong One!

Unfortunately when someone tells you the average return of an investment, they may not be telling you the right (or useful) number.

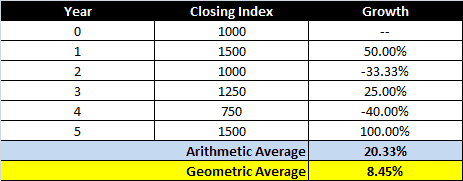

Consider the following two ways to calculate the average of a data set – the arithmetic average and the geometric average:

Image may be NSFW.

Clik here to view.

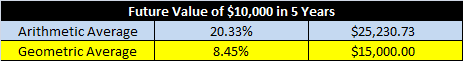

What’s the difference? Quite a bit! Consider what $10,000 would look like in 5 years using each of these average percentages:

Image may be NSFW.

Clik here to view.

Which one is the right one?

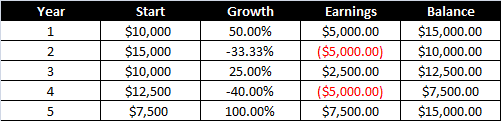

To answer that, how about we plug some numbers in and actually figure this out the long way:

Image may be NSFW.

Clik here to view.

As you can see, the geometric average was the one that matched! Why is that?

Without getting too technical, the difference is that the geometric average takes into account compounding affects while the arithmetic average does not. If you go back to our 8% index fund example, notice how 8% grows on top of the “total” amount of money from the year before. That’s the power of a compounding rate of return.

Coincidently, the geometric average is also called an annualized rate of return, and this is the figure that most professional documents use.

Remember that if someone presents a set of data to you, they may NOT be using the geometric average or annualized rate of return, and their return rates may lead you astray. Knowing the method behind the numbers will prove useful in validating the data for yourself.

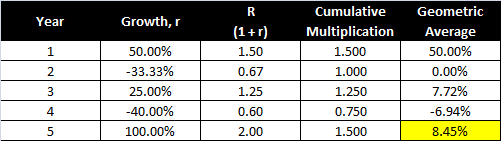

Nerd Alert! Here’s the Math:

If you have some annual return data and you want to figure this out yourself, it is pretty easy to do (especially if you’re handy with Microsoft Excel). The equation looks like this:

G=[ R1×R2×…×Rn ]^(1/n)

Where:

R=(1+r)

To put it in words, you start by adding 1 to each of your yearly returns, and then multiply them all together. Next apply an exponent of 1 divided by the number of values you have.

What does that look like in Excel? Here is the above example with the math shown to the right.

Image may be NSFW.

Clik here to view.

Try it for yourself and see if you get the same values I did.

Knowing how to do this yourself will allow you to run dozens of useful “what-if” scenarios. For example, what if I had invested in this type of stock? What if I had invested in that type of bond? All you need is the annual history of any investment to calculate your own rates of return and arrive at your own conclusions. The combinations of comparisons could be endless!

Readers: Did you know that there was a difference between these two statistics? Have you ever tried to calculate these averages yourself for any potential investments? Did running the numbers help you learn anything new? Did I put you to sleep with the math lesson?

Related Posts:

2) Why Compound Interest Makes You Rich!

3) Six Easy Steps to Figuring Out Your Retirement

The post What Does “Stocks Return 8 Percent Each Year” Actually Mean? appeared first on My Money Design.